09 November 2018

On 25 June 2015, a high-profile industry group unveiled a new satellite mission which promises to completely bridge the digital divide by 2019.

In the famous Faraday Lecture Theatre at the historic Royal Institution of Great Britain in London, the heads of Airbus Group, Bharti Airtel, Hughes Network Systems, Intelsat, Virgin Group and Qualcomm revealed what was hailed as a “ground-breaking global communications system” based on a fleet of microsatellites that will orbit the planet at low altitudes.

The companies are among the first round investors backing tech entrepreneur Greg Wyler’s OneWeb venture which is working on putting 900 microsatellites into space, starting with the first 10 towards the end of 2018 (also see pp 12-13, Southern African Wireless Communications, May-Jun 15 issue).

Wyler is no stranger when it comes to pioneering telecoms. He helped launch some of the first networks in Africa when he owned Terracom Communications in Rwanda during the early 2000s. In 2007, he founded O3b Networks (now owned by SES) which has created what is often described as a ‘fibre in the sky’ trunking network using satellites that are placed in medium Earth orbit (MEO).

But unlike O3b’s fleet which orbits the planet at an altitude of just over 8000km, or conventional geostationary (GEO) satellites which are around 36,000km away, OneWeb will place its spacecraft into a low Earth orbit (LEO) of just 1,200km.

Since OneWeb made its announcement three years ago, several other companies have also been developing LEO programmes that aim to provide ubiquitous and affordable connectivity from space.

Fleet Space Technologies, Global IP, Kepler, LeoSat, Sky Space and Global, and Telesat are some of the players that feature prominently here.

But the names of the major GEO satellite players are conspicuous by their absence. So if LEO space technology is the answer to bridging the digital divide once and for all, why have the more established operators never invested in it?

Speaking at the OneWeb launch event in 2015, Intelsat CEO Stephen Spengler said: “We have a different focus and a very large installed base of customers that we are serving with our GEO fleet. The bulk of the applications can be supported very well from GEO, and so we’re going to continue with that as the core of our strategy.”

So why is Intelsat part of the initial consortium of investors that has backed OneWeb to the tune of around USD2bn? Indeed, it even tried to merge with the firm earlier in 2017, although the proposed deal collapsed (see p13, Southern African Wireless Communications, May-Jun 2017).

“We can’t do the poles effectively,” said Spengler. “So what a LEO system does is that it allows us to work with our mobility customers and give them pole to pole, high-performance coverage.”

Intelsat’s plan is to integrate its GEO satellites with OneWeb’s LEO fleet in an effort to connect customers globally and seamlessly.

Spengler also believes working with OneWeb will give Intelsat another layer of capacity in certain cases, such as helping to ease the congestion that can occur with spot beam systems.

“And there are going to be some situations where the low latency of a LEO system will be beneficial. We don’t believe latency is an issue across the broader set of applications, but in certain applications it’s going to be beneficial for certain customers, so we’ll be able to bring that to the equation.”

OneWeb’s first round investors include some big name ICT and tech players. Shown here at the company’s launch in 2015 are (from left to right): Dean Manson, EVP, general counsel and secretary, Echostar (Hughes Network Systems); Stephen Spengler, CEO, Intelsat; Richard Branson, founder, Virgin Group; Sunil Bharti Mittal, founder and chairman, Bharti Enterprises; Greg Wyler, founder, OneWeb; Tom Enders, chief executive, Airbus; Dr. Paul E. Jacobs, former executive chairman, Qualcomm.

Who’s interested in LEO?

When it comes to some of the other big names in the satellite industry, SES is clearly now committed to MEO and acquired all of the remaining shares in O3b for USD730m in August 2016.

And following a request for its views, a Eutelsat spokesperson told us: “We do not have interest in LEO communication”.

This contradicts an announcement Eutelsat made in March 2018 which stated that the company had commissioned its first low Earth orbit satellite (see p6, Northern African Wireless Communications, Apr-May 2018). Eutelsat has so far not responded to a request for further clarification here.

Meanwhile, Ken Betaharon, EVP and CTO of ABS (Asia Broadcast Satellite) appears almost dismissive of the LEO satellite providers when he says: “Except for a small portion of the current traffic which may be latency sensitive, there is no need for a LEO system, especially if [the operator’s] business plan entails competing with GEO systems and provide the same services. A GEO system can do it all at a much less cost than a LEO solution both in terms of the satellite cost and the ground segment cost (user terminals). So why bother?”

Why bother indeed, especially when the idea of LEO satellites is not new and has been tried before without much success.

During the 1990s, Teledisc had ambitious plans to launch 840 satellites at an altitude of 700km. Globalstar and Iridium also had similar plans. But the programmes cost billions of dollars and did not take-off commercially. (However since then, Iridium has gone on to develop its NEXT programme. Here, it has already successfully launched 65 LEO satellites and expects to have a total of 75 in space by the end of this year. Of these, 66 will be operational and 11 will be spares.)

So why has there been renewed interest in LEO missions during recent years?

Perhaps the best companies to answer this are the ones who are investing in the technology today, such as US-based LeoSat Enterprises.

Working with Thales Alenia Space, LeoSat plans to manufacture and launch a constellation of up to 108 Ka-band high-throughput satellites (HTS).

These will be interconnected through laser links which, according to LeoSat, effectively creates an optical backbone in space which is about 1.5 times faster than terrestrial fibre backbones.

LeoSat expects to begin its launch in 2021 with full deployment expected in 2022. CCO Ronald van der Breggen believes that with the continuing growth of the data market worldwide, the satcoms sector is looking to deploy LEO solutions that will enable telecom and satellite operators to complement their current portfolio with suitable capabilities for future demand.

He goes on to point out that two major established GEO companies have now invested in LeoSat: Hispasat, the Spanish national satellite operator, and SKY Perfect JSAT, Asia’s largest operator.

“Both believe that LeoSat’s system design – combining satellite and networking technology to provide an MPLS network in space – is a departure from existing solutions and a key opportunity for opening up new markets and delivering business growth.”

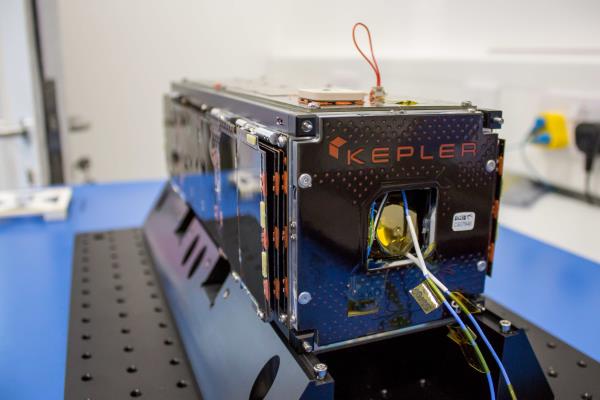

Canada-based Kepler is another recently established company that plans to gradually deploy a constellation of 140 LEO nanosatellites while delivering store-and-forward data backhaul and IoT services worldwide.

Its CEO Mina Mitry believes that the space industry in general has seen “incredible growth” in past years, and that the standardisation of nanosatellites has significantly influenced how LEO spacecraft can be built and deployed.

He says: “Since off-the-shelf components used for LEO [satellites] are significantly cheaper and the availability of launch vehicles is multiplying, access to space is now remarkably being redefined. This is making it easier for new entrants to access the space market through rapidly deployable nanosatellite constellations, providing a diverse array of new services and applications.”

Mitry reckons the reason the more established operators have not invested in LEO is simply because it is not their business.

He also suggest that they lack the skills to do so. “To operate in LEO, you require a certain expertise that is not easy to transfer from GEO since these two orbits have different complexities and challenges. The technologies are fundamentally different – mostly inherent to the design and operation aspects – and require a specific body of knowledge to successfully compete at each orbit.

“Moving to a LEO system means that a GEO operator would need to take time and resources away from their mainstay business. When you have quarterly earnings reports, investor calls, and a plethora of demanding customers, the opportunity cost for investing in a new capability is simply too great to bear.

“With small satellites you can ride-share to orbit, the radiation environment is more forgiving, and cost of launch is cheaper. This drives down cost, meaning you can build more satellites that are rapidly refreshed.”

Frederick Morris, VP of satellite operators market vertical with satellite technology specialist Comtech EF Data, agrees here. He says GEO satellites are generally large, designed for long life, and are therefore expensive to manufacture and launch, which limits the numbers being built. But LEO and MEO satellite constellations can have anywhere from two dozen to 6,000 satellites driving scale, which is always good for economics.

In addition to the individual cost savings from volume production, Morris says the cost of a line of software code has also plummeted, making the much more complex control (compared to GEO) of LEO constellations far more feasible than before.

“With the enhancement in satellite technology and the enhancements in launch capability, what was once considered science fiction is now becoming science fact, and the potential user benefits are becoming realisable.”

Reaching high with low orbit satellites

According to Kepler’s Mitry, LEO satellites offer “significant” advantages over their GEO counterparts for certain applications.

“Naturally, each orbit has its own unique set of characteristics that pre-define the type of service and coverage it can offer. GEO satellites are particularly good at supporting direct broadcast and fixed connectivity services. MEO and LEO satellites instead are far more suitable for delivering mobile satellite services, including IoT services.

Mitry says satellites orbiting at less than 2,000km mean considerably less latency than those in geostationary orbits that are much further away. Because LEO satellites fly closer to the planet, he says they do not suffer from the signal path losses of GEO satellites, and can therefore be used with smaller antennas and less power on the ground.

He also points out that in general terms, the higher the orbit the harsher the radiation environment, and the more effort needs to be put into ensuring that the spacecraft’s electronics can survive.

“This not only drives up development effort but means GEO electronics lag behind their terrestrial counterparts in terms of performance. Radiation events, such as single event upsets or latch-ups, are much frequent at higher altitudes and can be incredibly damaging to electronics. In the lower radiation environment of LEO, small satellites can use commercial off-the-shelf components, again reducing the costs and improving the performance.”

Mitry also highlights the fact that GEO satellites are designed to have a lifespan of around 15 years, largely owing to the buyback period needed to recuperate the original investment. But he says the typical service life expectancy of small satellites is under 3-5 years which makes it easier to upgrade technology with the latest advancements.

LeoSat says its satellites will fly at an altitude 25 times closer than GEO spacecraft, and claims it can provide the type of networks required for “true” data networking. Photo: Thales Alenia Space

“Broadband and data applications benefit from low-latency communications, which is where LEO constellations provide an advantage over geostationary satellites. For data communications, the LeoSat constellation can even outperform fibre on inter-continental networks. For example, current fibre latency for New York City-Tokyo is 175ms – the LeoSat solution is below 100ms.”

The issue of latency comes up time and again during conversations about LEO. However, ABS’ Betaharon says that while LEO satellites offer some advantage in terms of latency, this is only required for a very small portion of current traffic and is a “huge disadvantage” in terms of the cost.

He also agrees that LEO systems may have an advantage over GEO for providing service in some very specific targeted markets, such as above and below the Arctic Circle where very few people live.

Hence, as part of their universal service obligations, he says some governments may invest in LEO satellites to provide services to their citizens living in remote areas, citing Canada-based Telesat as an example.

“Considering that very few people live in the extreme northern part of Canada (80 per cent of the country’s population lives within 80 miles of the US border), this does not make financial sense. But for a government helping its people and targeting some specific markets, it does make sense.”

Telesat’s fleet currently consists of 16 GEO satellites as well as the Canadian payload on ViaSat-1. In January 2018, it launched a phase 1 LEO satellite that is currently undergoing commissioning and orbit-raising.

The company says its LEO fleet will offer a low latency, high throughput broadband service with an initial constellation of around 120 satellites planned by 2021.

Comtech EF Data’s Morris explains that a LEO satellite hop can be approximately 40ms while a GEO hop can be around 550ms.

“This sounds as if there would be no question that if latency forced a choice to be made, it would be LEO over GEO. However, there are satellite configuration differences within the proposed LEO constellations, and it has to do with whether there are inter-satellite links (ISLs) between satellites or not.

“If the constellation has ISLs, then a ground station can connect to another ground station or gateway station by a hop up to the satellite, then over to a satellite covering the geography of the other end of the link, and down to the ground station. SpaceX’s Starlink, Telesat LEO and LeoSat have ISLs in their constellation designs.”

Without ISLs, Morris says the signal must go from ground station to gateway, to possibly a terrestrial link to another gateway, then up to a satellite covering the destination, then down to the end point station.

“This type of constellation configuration, with multiple hops, can have implementations that can have close to the same latency of a single GEO satellite hop.”

Andrey Kirillovich, director of integration services and projects, for the Russian Satellite Communication Company (RSCC), also plays down LEO’s latency advantage. He says that while latency is essential for response time, critical applications in corporate networks and verticals, or online gaming, when it comes to the satellite service provider’s overall business, such traffic does not exceed 10-15 per cent.

In addition, Kirillovich says new 5G mobile network features will not run smoothly on LEO, as the 5G standard requires latency around 1ms, and this can be achieved only on the ground.

“So the benefit of LEO systems is really questionable, while the disadvantages are great in number. They include numerous launches, the need for constant renewal of the satellites in space, and the main bottleneck – the absence of a proven, mass production and easy use steerable antenna. As of today and even in the near future, the cost of a non-GEO terminal will be too far from GEO costs, purely because of the RF part.”

While acknowledging that LEO satellites offer a major advantage over their GEO counterparts in terms of offering true global coverage, Kirillovich goes on to ask at what cost?

Echoing ABS’ point above, he says: “LEO coverage is continuous and achieved by hundreds or even thousands of satellites. Many of them will, most of the time, cover oceans with no customers there. So the effectiveness of such a system and its advantage over GEO by adding coverage over the poles is questionable. It may be effective, but for regional use, or in certain verticals only.”

On top of all this, Caroline De Vos and Fulvio Sansone, co-founders of satellite services provider SatADSL, point out that LEO satellites are also perceived to be in motion by a user on Earth, so terminals need to be able to connect to a moving object in the sky.

They say: “This means the use of either omnidirectional or tracking antennas is necessary. The former can only use lower frequency ranges and are therefore limited in bandwidth and efficiency which means higher communications costs, while the latter is, until now, based on motorised, mechanically moving dishes which are costly and bulky.

“Additionally, the user terminal and its antenna need to be able to cope with handover between one satellite fading out of view below the horizon and another one rising over it. These challenges can only be economically addressed by using a new generation of antennas based on flat-panel electronically steerable elements. Such technology is still at its infancy, and it is not yet possible to have low-cost mass-produced electronically-steerable flat-panel antennas with satisfactory performances.”

Morris amplifies their points when he says that as LEO satellites rise and set, the time that an individual one is visible may be between 10 and 25 minutes.

“So that traffic is not interrupted, it is likely that there would be two antennas at the Earth station location, one online and one off-line, where they hand-off traffic as a ‘new’ satellite rises and an ‘old’ one sets.”

For Morris, connecting with moving satellites implies more complex and currently more expensive ground segment equipment. He reckons this may initially limit LEO’s use to markets where the benefits of low latency can command a premium price.

Others may not agree here, especially with companies such as AddValue, Hughes Network Systems, Isotropic and Kymeta who are all making significant in-roads into developing the ground technologies that will be needed to support LEO constellations and applications.

It’s all about the app

For SatADSL, the most important advantage of GEO satellites over LEO and MEO comes when you need to transfer a single content to many users in real-time.

“This is the case with linear, real-time television” say De Vos and Sansone. “This is the killer application of GEO satellites and, at least for these types of applications, GEOs are here to stay.”

Kirillovich is likely to support this argument, and says GEO constellations have the added advantage of having a track record that spans more than half a century.

“They have been changing and adapting to the market, starting from 16m antennas working in C-band in the past and now reaching 0.6m antennas working in Ku- or Ka- bands, with RF costs below USD100.

“GEO has always produced an innovative response to market challenges – the latest response for better throughput requirements was GEO HTS, which can accommodate hundreds of Gbps or even a Tbps on a single satellite

"In combination with GEO wide beam satellites, GEO HTS can also provide almost global coverage and a massive throughput delivering true broadband connectivity to the places where it is needed. To reach global coverage, you need to launch just three GEO satellites. In LEO you will need hundreds of them.”

Ultimately perhaps, the industry should not be arguing about LEO versus GEO and the prospect of a looming ‘format war’ in space. What’s clear is that each orbital sector is good for different applications

Kepler’s Mitry admits that the ground segment for LEO always needs some tracking mechanism, whether it be mechanical or electrical. While this makes LEO satellites less suitable for fixed applications, he says they are “very suitable” for mobile applications which, regardless of LEO or GEO, need ground antenna tracking.

Kepler successfully launched its first satellite, KIPP, in January 2018. It will launch two more proof of concept spacecraft before rolling out its 140 satellite GEN1 constellation in 2019. Each CubeSat will be around the same size as a loaf of bread.

LeoSat’s van der Breggen lends his weight to the argument and says: “GEO satellites are mostly used for communications connectivity for remote regions where fibre cannot reach and for broadcast applications. So GEOs are superior for broadcast but inferior for data, hence they are losing to fibre all the time. For data communications, the simple answer is that GEO constellations cannot beat LEO or MEO.

“LEO constellations such as LeoSat, at an altitude 25x closer than GEO, have many advantages when it comes to throughput, latency and true global coverage and can provide the type of networks required for true data networking.LeoSat’s solution means that satellite, rather than being considered as a last resort for data networking, can become superior again and the solution of choice, reclaiming its position and staying relevant in tomorrow’s world which is about data, not video.”

When fully operational, van der Breggen claims LeoSat will provide point-to-point data connections to and from anywhere on Earth without the need for any terrestrial landings or transport. Combining what’s described as “advanced” on-board routers with inter-satellite laser links, van der Breggen says LeoSat will provide low-latency and gigabit per second data delivery which is “ultra-secure and extremely resilient”, thanks to its gateway independent meshed-network data-connectivity from transmitter to receiver.

“The unique features of LeoSat’s system – ubiquity, low-latency, speed and cyber security – are ideal for a number of applications, such as: enabling global 4G and 5G satellite connectivity for cellular operators; providing the bandwidth required for energy, maritime or financial sector operations; delivering secure networks for government and defence communications; ensuring critical emergency communications; and enabling internet access and connectivity for remote communities.”

In January, Kepler successfully launched its first spacecraft, KIPP, which Mitry claims is the only provider of pole-to-pole high-capacity Ku-band satellite services.

“We deliver store-and-forward communication services to remote customers that lack access to terrestrial networks and have bandwidth constraints with its current satellite providers,” he says. “As we roll out our constellation we will incrementally service other markets as well, such as M2M and IoT.”

Kepler’s second spacecraft, CASE, is scheduled for launch later this year.

Mitry explains that each spacecraft is approximately the size of a loaf of bread and built based on the standardised CubeSat form factor.

“These sister satellites will perform a technology demonstration mission of the performance of our LEO communication system. We are launching our third satellite next year. TARS will expand upon the capabilities of KIPP and CASE and deliver narrowband connectivity services for IoT devices.”

TARS will be the final prototype prior to Kepler’s roll out of its GEN1 constellation beginning in 2019. It will establish the capacity and performance required from the company’s future constellation of 140 satellites.

Meanwhile, despite RSCC’s passion for GEO, the company has not dismissed the possibility of using other orbital planes.

While the operator’s fleet is still relatively new (having been renewed in 2013-15) Kirillovich says non-GEO spacecraft will be a part of the development strategy by 2023.

“Non-GEO has got only one advantage over GEO – coverage on the poles and a better elevation angle at northern latitudes. RSCC’s primary domestic market is Russia where the majority of territory is located above parallel 50N, so the elevation angles from GEO are below 30º. Taking this into account, RSCC plans a regional constellation of four satellites at highly elliptical orbit (HEO), which provides ideal elevation angles over Russia.”

Kirillovich believes that a non-GEO constellation can offer supplementary support to a GEO operator and improve the quality of services for customers in certain vertical markets, such as mobility.

He says RSCC’s main target for its HEO satellites – named Express-RV – will be mobility users (trains, buses and ships). “Undoubtedly, if any of the new mega [LEO] constellations come into being, they will be a good add-on to the GEO offerings in the market – but only on a secondary basis to fill the gaps,” he concludes.