21 May 2018

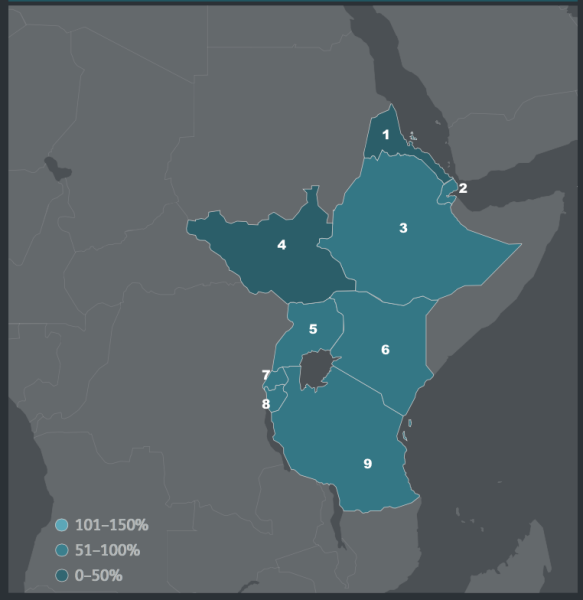

Mobile penetration in East Africa as at 4Q17. (1) Eritrea; (2) Djibouti; (3) Ethiopia; (4) South Sudan; (5) Uganda; (6) Kenya; (7) Rwanda; (8) Burundi; (9) Tanzania. SOURCE: OVUM FORECASTER

East Africa will have 186m mobile broadband connections by 2022, according to Ovum.

In a report published in mid-May, the analyst said mobile data will be the key growth driver for the East African telecoms market in the next five years to 2022.

The forecast for mobile broadband (MBB) in Kenya, Tanzania and Uganda is 112m subscriptions at end-2022, while the forecast for MBB in all nine East Africa countries is 186m subscriptions at end-2022.

(As well as the countries named above, Ovum’s also includes the following in East Africa: Burundi, Djibouti, Eritrea, Ethiopia, Rwanda and South Sudan.)

The firm said MBB growth will be powered by increased deployment and upgrade of 3G and LTE networks, as well as a rise in smartphone penetration due to better affordability.

It forecasts that there will be 32m LTE subscriptions in Kenya, Tanzania and Uganda by 2022, while smartphone connections will be 108 million.

Furthermore, Ovum pointed out that there has been a sharp rise in demand for broadband services from consumers in the region fuelled by the ongoing digital transformation.

MEA research analyst Danson Njue said: “The East African region has made great progress in broadband connectivity over the last few years, and this has unlocked great potential in digital services segment, including mobile financial services, digital media as well as enterprise services.”

However, Njue also warned that growth in broadband connectivity has also seen a rise in OTT services, thereby increasing chances of data revenue “cannibalisation” for data service providers in the region.

In a separate report published in April, GlobalData said that average monthly mobile voice usage per subscriber in the MEA region will remain stable until 2018, despite the growing adoption of OTT voice applications.

GlobalData also said that despite the growing number of mobile data subscribers, the average monthly mobile minutes of use per subscriber (MoUs) has grown in a number of markets in the Middle East and Africa.

It said that in Tunisia, for example, Ooredoo and Tunisie Telecom have been offering generous mobile voice bonuses for pre-paid customers, such as a 1,000 per cent bonus on top-ups, starting from TND5 (USD2.1).