24 January 2020

Admin will be able to see things like cracks and water damage from afar to help it issue short-term policies quickly. This helps to significantly reduce its risk exposure to fraud.

“In the past, insurance companies needed to physically inspect devices in-person to accurately assess their condition or accept the risk of fraud while selling device insurance,” said Mark Clark, chief operating officer at Admin Plus. “With the implementation of HYLA’s Advanced Diagnostics, our inspections can be completed remotely, thereby reducing the risk of fraud while increasing the convenience to our customers.”

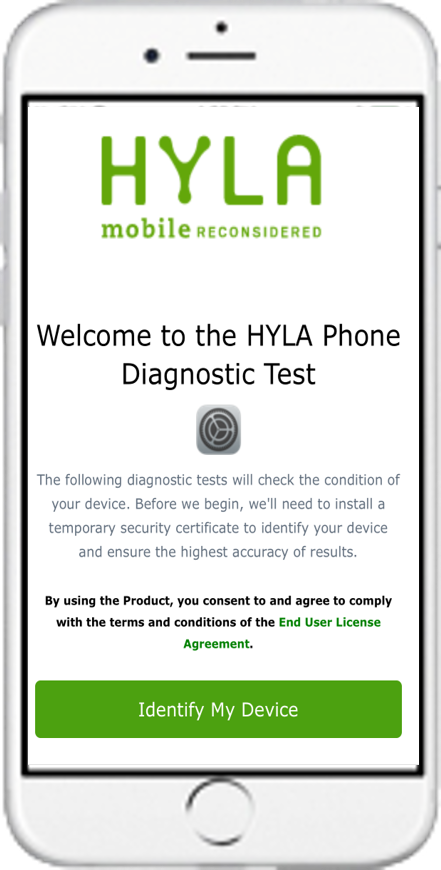

HYLA’s advanced diagnostics leverages patented AI technology to determine the condition of a device – specifically, whether it functions as expected (e.g. digitiser, cameras, accelerometer) and that the screen is not damaged. To complete the screen assessment, the app captures an image of the screen and processes it via a cloud-based Machine Learning algorithm, which provides a crack/no-crack response in under two seconds.

Further, it employs advanced fraud detection by capturing the unique International Mobile Equipment Identity (IMEI) number that can be recalled and matched to any future claims.