04 September 2020

Africa’s overall mobile phone market saw shipments decline just 6% quarter on quarter (QoQ) in Q2 2020, according to the latest set of figures released by technology research and consulting services firm, International Data Corporation (IDC).

Its newly-released Global Quarterly Mobile Phone Tracker found that Africa’s smartphone market remained flat in Q2 2020, experiencing just 0.1% growth QoQ, while the region’s feature phone shipments declined 10.6%. IDC said the impact of the Covid-19 pandemic on smartphone shipments has been felt differently across the region.

Shipments to South Africa and Nigeria declined 16.8% and 6.8%, respectively, QoQ in Q2 2020, while Egypt recorded a 2.2% increase. Both South Africa and Nigeria adopted strict lockdown measures in April and May, which included the closure of non-essential businesses. In contrast, Egypt adopted a more flexible approach and allowed limited hours of business operations during the second quarter, the company added.

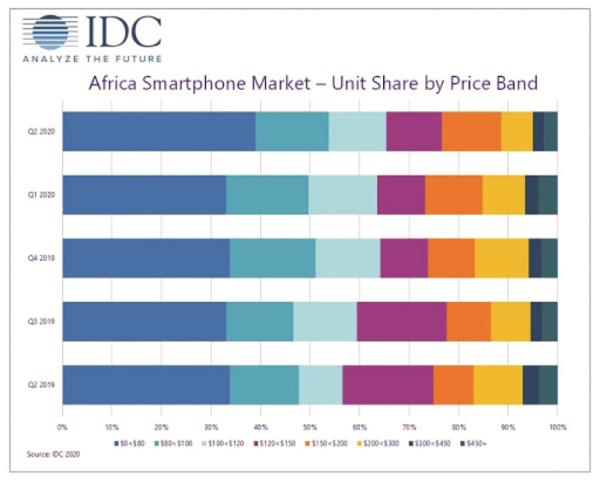

The average selling price (ASP) for smartphones declined 9.8% QoQ in Q2 2020, partially due to the market conditions created by the pandemic and partially due to a continuation in the declining trend of prices. The US$0 “Despite a striking increase in online sales, the channel still only accounted for 3.2% of the total mobile phones shipped across Africa in Q2 2020,” says Ramazan Yavuz, a senior research manager at IDC. “Development of the online channel remains fragmented across the region and the infrastructure needs more investment to reach a more promising stance. While the top countries and urban centres benefited from online sales, the diffusion to a larger audience requires time.” Elsewhere, 4G/LTE-enabled devices saw their share of smartphone shipments increase to 81.1% in Q2 2020, spurred by the declining ASP of these devices. “The absorption of 5G-enabled smartphones in the market remained below 1% as the cost of 5G devices is prohibitively high and beyond the reach of most consumers,” said George Mbuthia, a research analyst at IDC said. “Also, the telecom infrastructure required to underpin 5G adoption is still undeveloped, with most countries still only conducting limited 5G trials.” IDC said it expected Africa’s smartphone market to grow 4.2% QoQ in unit terms in Q3 2020 and by 4.4% year on year in 2021 as markets start to recover from the negative effects of the global pandemic. With the reopening of markets, the retail channel is also expected to recover, although not to the levels it enjoyed before the pandemic.