10 August 2020

Cellular networks might appear ubiquitous these days but they have their limitations. No matter how good the coverage statistics are, they never cover 100 percent of the land, and very little of the sea. So if you need genuinely global communications then you need to look at satellite solutions.

There are many vendors who offer satellite connectivity and even plenty of firms with satellites in orbit, but before you worry about that, you have a choice to make – GEO or LEO.

What are GEO and LEO?

GEO is short for Geosynchronous Equatorial Orbit. GEO satellites orbit along a path parallel to Earth’s rotation at a height of around 35,000km (22,000 miles) above the Earth’s surface. Also known as geostationary satellites, they stay located above the same physical point on the Earth at all times, thereby providing coverage to an area surrounding that location. Typically used for weather forecasting, satellite radio, television, data connectivity in remote locations.

LEO stands for Low Earth Orbit. LEO satellites revolve around the earth at an altitude between 160 to 2,000 km (99 to 1,200 miles). Unlike GEO they don’t necessarily stay above the same point on the surface of the Earth, for example an Iridium satellite flies at approximately 17,000 mph and completes an orbit every 100 minutes. The orbits also don’t have to be around the equator, again for example Iridium has six rotational planes that are all longitudinal and pass over both poles of the planet (see PIC 1). Typically used for communications or imaging applications.

Interest has piqued in LEO constellations recently, where a network of low-Earth orbit satellites provide a cross-linked network around the whole globe, but the history of both technologies goes back many decades. In fact it was Telstar 1, launched into a low orbit on 10 July 1962, that was the first satellite to transmit live television images between Europe and North America. Whereas the first geostationary communications satellite didn’t launch until 19 August 1964, the Syncom 3 was used to telecast the 1964 Summer Olympics from Tokyo over to the United States.

Location location location

“Fundamentally, GEO has the advantage of being a highly cost efficient and the most robust way of providing communications links from space,” says Kyle Whitehill, CEO, Avanti Communications.

He goes on to point out that the GEO communications market has successfully grown on the basis of its unique capability to cover a huge region of the earth, one third, from a single location. This coverage only takes a single launch and a single satellite with a lifespan of more than 15 years.

It’s not all plain sailing though. “Due to the fixed nature of GEO satellites, signal blockages between a user and satellite can easily occur,” says Iridium, which owns and operates a LEO network. “Since LEO satellites are always moving, the chances of a long or persistent signal blockage are greatly reduced.”

There’s also the subject of latency. The times it takes for a signal to transmit up to a satellite and bounce back down to Earth will rely on how far away the satellite is. A higher orbit will necessitate a longer round trip, a larger latency.

Globalstar has a LEO constellation of 48 satellites and sees low Earth orbit as the ideal location for their purposes. “Assuming similar ground processing delays, LEO satellites such as Globalstar’s demonstrate about 10 times less propagation time, in other words, less latency,” says Gavan Murphy, Director of Marketing EMEA, Globalstar.

Whitehill doesn’t see this as a problem. “To date, the round trip time of a GEO signal of half a second has clearly not been an inhibitor to the development of the GEO market,” he says. “The requirement for low latency satellite connectivity is limited and niche given that in most cases demand for low latency is concentrated in areas where there is or will be fibre and cellular wireless networks.”

However, Murphy believes that there’s more to be gained than just a reduced latency. He believes that service reliability is improved by using low earth orbit. “It’s simple physics,” he says”. “With LEO, because the satellites are moving relative to the planet, there are fewer handoffs for calls or transmissions. When a LEO satellite picks up a signal, it ‘hand delivers’ it directly to a gateway.”

The idea is that the fewer the handoffs, the better the reliably. “And while geostationary players argue about the effects of weather, smaller LEO satellites just get on with the job,” finishes Murphy.

Spacecom’s Amos-17 geostationary satellite has C-band spot beams covering a large proportion of Africa, some Ka-band steerable beams centered on Nigeria and South Africa, and Ku-band beams covering Western Africa and Southern Africa

The cost equation

A key factor for any business is the cost. “A priority for Globalstar since our inception is the delivery of services that are competitively priced and consumer-friendly”, says Globalstar’s Murphy. However he acknowledges that in order to provide coverage it’s necessary to have many more satellites than the comparable GEO setup.

“But the spacecraft are smaller and are less complex, with fewer components, so they are less expensive to build. They are also lighter, making them more economical to launch and to replace,” he says. It’s these factors that he believes help keep operational costs for the LEO fleets lower than for GEO. Consequently, service prices for end users can be lower.

Both technologies use the ‘bent pipe’ principal, where a signal from Earth is transmitted to the satellite only to be amplified and sent back on a different frequency. This avoids the satellite having to decode and re-encode the signal, leading to simpler systems required in orbit. The consequence of this is that most of the ‘intellgence’ can reside on the ground which helps reduce costs.

Murphy thinks that LEO has another cost benefit. “LEO requires less switching, therefore requires less on-the-ground investment, but provides the high reliability and flexibility to add bandwidth as needed. The system benefits from easily upgradable ground infrastructure,” he says.

This could be a vital factor for LEO because the satellites could well be its downfall. “It wasn’t until the 1980s that engineers began to challenge the effectiveness of GEO satellites,” says Iridium. “That’s when the idea for a LEO satellite constellation first occurred. A small group of engineers at Motorola began researching and designing a LEO satellite system that allowed the satellites to communicate with each other through cross-links.”

This cross-linked architecture can provide the additional advantage that communications can be “grounded” near their desired destinations, but it requires many satellites to make this work. Iridium, for example, has a network of 66. This is something that Whitehill sees as a big problem.

“The expected lifespan of a LEO satellite is 5 years and although launch costs have reduced and multiple satellites can be launched together it is difficult to comprehend how the business case for LEO is sustainable,” he warns. “Other factors include the complexity and therefore cost of operations of LEO constellations in some cases 1000s of satellites compared to the operation of singular GEO units.”

He additionally thinks that the cost of tracking and switching modems is still very high and unlikely to reach mass market production for many years.

The technology battle?

Neither camp is resting on its laurels though. For example, Whitehill points to the advent of phase array antennas which have reduced the terminal size for GEO to now being portable.

Another big problem for geostationary satellites is the time taken to get them from the drawing board and into the air. “One downside of GEO’s which is progressively being addressed by advances in technology and production techniques, is the time from design to launch which can typically be 5 years,” he says. He believes this will give GEO the edge over LEO which he says suffers from the cost of continuously having to build and launch the short lived LEO spacecraft which are highly susceptible to failure and collision, despite how much cheaper those satellites are to build and launch.

Iridium, however, doesn’t see this as being a battle. Geostationary satellites often offer C-, Ka-, and Ku-bands (for example, see PIC 2 & PIC3). “C-, Ka-, and Ku-band systems are used for satellite TV and VSAT networks,” says Iridium. “LEO networks, like ours, are traditionally L-band systems, which operate in the lower part of the radio spectrum, around the same frequencies as mobile phones.” The benefit of this is that L-band is renowned for its ability to send and receive transmissions even in adverse weather conditions because lower frequencies are less susceptible to interference from atmospheric and weather conditions.

The topology of a cross-connected web of satellites with a much lower latency also offers improved voice calling, claims Iridium. “Regardless of where a user is, anywhere on Earth, from the North Pole to South Pole, our LEO constellation ensures dependable communications with a quality user experience.” This is particularly true for users at high latitudes who might not be able to get GEO coverage at all.

Murphy, much like Whitehill for GEO, believes that progress is being made to make small consumer devices available for LEO too. He also thinks that LEO doesn’t have to fight GEO because it has niches that it is ideal for. “For example, our LEO constellation and L-and S-band are perfect for IoT applications,” he says.

So perhaps it’s not an ‘either/or’ situation. Maybe it’s down to your use case and whether can you make the numbers add up.

The business case

“The business heritage for GEO satcoms is over 40 years in the making and, as in any business sector, it has adapted with the changing demands and evolving technology,” says Whitehill. “It has proven to be highly successful for sectors such as broadcasting, defence, mobility, and backhaul to remote regions.”

He says that Avanti Communications intends to make further investments in GEO. “We will adapt our service capabilities and adopt the latest and best technology development based upon a solid GEO strategy. We are actively investigating the latest in software defined satellites, digital on-board processing and smallsat technology.” The company’s focus is on the Defence, Industry, and Carrier sectors and high value customers that require the reliability and flexibility of GEO systems and are “prepared to pay for it”.

However, there has been a recent buzz about LEO networks. Three big-name entrepreneurs are all involved in trying to launch networks: Elon Musk (SpaceX’s Starlink which has almost 300 satellites operational), Sir Richard Branson (OneWeb with 74 out of 648 satellites launched), and Jeff Bezos (Amazon’s Project Kuiper still at the R&D phase).

Globarstar’s Murphy certainly sees LEO as a sensible business choice. “The services and capabilities our network provides are designed for low power, small, low-cost devices for mass-market, with low airtime charges,” he says. “GEO satellites tend to use high Mbps. With their large payloads, the economics, scope and scale of the GEO operations and user base are of a different order.”

So much like with the technology, it isn’t so much of a battle, more a case of choosing the right tool for the job

Making your mind up

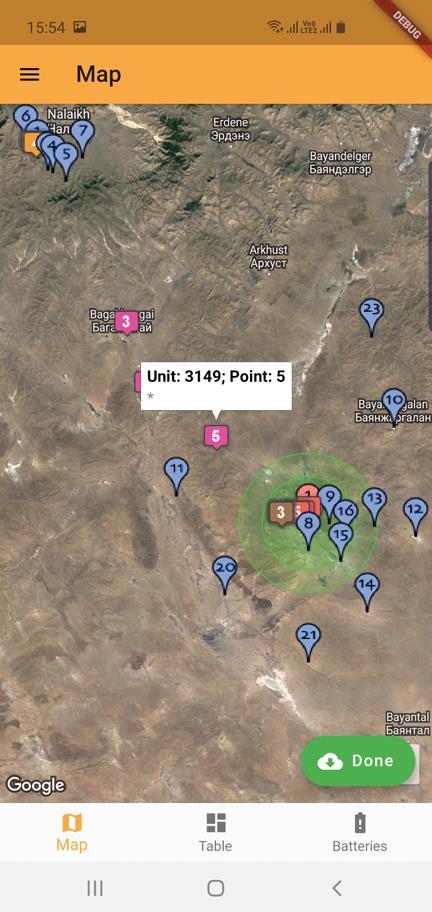

Globalstar allowing the tracking of horses for farmers in Central Asia

“Being able to offer businesses, organisations, and consumers reliable, ubiquitous satellite communications equipment that is economical, and airtime that is competitively priced, is a core priority for Globalstar. But it is particularly important for the fast-developing countries in Africa,” says Murphy.

Whereas Whitehill says, “we provide wholesale MHz and Mbps on fixed HTS networks across the EMEA region and we provide highly agile and secure steerable beams to relocate high performance and high throughput where and when the customer needs it. This is a different market requirement to that of the LEO market.” However, he does concede that if Avanti Communications encounters specific demands from its customers then it would partner with a LEO constellation operator.

His final mantra for choosing a solution,”at the end of the day, the deciding factors are simple to summarise as cost, cost & cost!” But he offers one final warning, “whereas the key USPs of a LEO system are low latency and smaller terminals, the demand has yet to be proven both on paper and in service and as low latency is only achievable with a sizeable constellation of several hundreds of LEO satellites, the business case is questionably risky.”

This is particularly poignant as OneWeb filed for bankruptcy in March 2020, blaming the Covid-19 crisis as the reason it failed to secure any new investment but subsequently was bought by a consortium of Bharti Global and the UK Government. It’s looking like Whitehill’s warnings about the business stability of LEO networks might have some foundation, but then it has always been a case of finding a reliable partner to provide you with the services you require.

If you absolutely need low latency then a LEO network is undoubtedly the best option, but if not then perhaps you’re better off finding a provider than can offer you both solutions and a degree of protection against individual networks going bankrupt.