16 February 2022

How submarine cable systems point the way to economic growth, by Geoff Bennett, director, solutions and technology, Infinera

t’s estimated that submarine communication cables facilitate over U$10tn in global trade per day. For rapidly growing regions of the world like Africa to have full access to this flow of digital commerce, they need to have reliable, high-capacity subsea cable connections. This is even more important as the epicenter of internet traffic shifts away from the U.S. and toward a far more equitable balance of traffic around the globe.

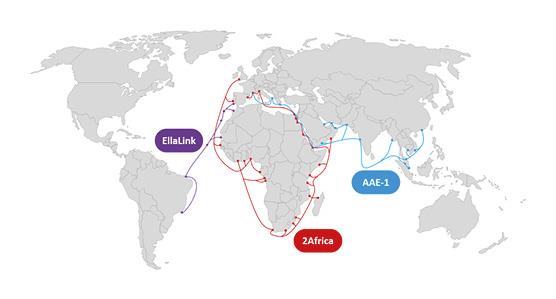

In response to this need, in recent years we have seen new, high-performance cables providing higher capacity and lower latency for connections between Europe, the Middle East, and Asia, as well as new direct cables between Europe and South America.

The longest Submarine cable in the world today

The Asia-Africa-Europe-1 (AAE-1) cable is a great example. A 25,000-km cable system that connects Southeast Asia to Europe via Egypt, it is the largest submarine cable to be constructed in almost 15 years. AAE-1 is a modern cable design, optimized for the latest generation of high-performance coherent subsea transponders. These are the active transmitter/receiver devices that are plugged into either end of the cable, and which inject high-data-rate optical signals at over 100 Gb/s per wavelength, with an initial design capacity of 40 Tb/s for the cable.

Note that, while a submarine cable has an engineering design life of about 25 years, transponder evolution occurs in roughly four-year cycles, so new transponders can be deployed on existing cables to give them a mid-life boost in capacity. For example, over the past 20 years, the capacity of trans-Pacific subsea cables has increased by a factor of 357 times. But over that period, only 12 cables were laid. Most of that capacity growth has been achieved by submarine transponder evolution.

Lighting Up Africa

Another example is the rise of Africa in terms of internet presence and capacity. Today, the pattern of investment across the continent is highly skewed, with the majority of investment focused in South Africa. A report by the African Data Centres Association predicts that Africa needs to build 700 gigawatt-scale data center facilities across the rest of the continent to meet growing demands and to bring the rest of the continent in line with the capacity and density of South Africa.

We also see cable systems like Equiano coming into service this year down the West Coast of Africa, and the PEACE cable providing similar connectivity up the East Coast and branching towards Pakistan and up through the Mediterranean Sea to the European gateway location of Marseille.

Within Africa we see extensive use of mobile infrastructure, which was originally positioned as a way to leapfrog legacy copper telephone lines and provide inexpensive mobile connectivity quickly and easily. The GSM Association estimates that the mobile network industry in Africa contributes $184 billion USD into the GDP of sub-Saharan nations. But that mobile connectivity must be fed by fiberoptic links into local data centers and to long-haul and submarine networks, and this enhanced connectivity will play its part in helping to connect the 800 million people in the region who are on the wrong side of the digital divide and do not yet have reliable access to the economic, healthcare, and educational advantages of internet connectivity.

Possibly before 2Africa enters service, expect to see the launch in 2023 by Telecom Egypt of Hybrid African Ring Path (HARP), which, as the name suggests, is to form the shape of a harp around the African continent. HARP will link current and planned Telecom Egypt projects, enveloping Africa in subsea connectivity.

While soaring demand for bandwidth is a global phenomenon, it has been growing fastest on links to Africa. TeleGeography reports a compound annual growth rate of 54% for the region between 2016 and 2020, and the announced new cable systems feeding the continent will quadruple the previous capacity levels.

Submarine cable systems are vital to the digital economy worldwide. In the past, so much of this activity was centered on the U.S. but now Asian, African, and South American routes are increasing in capacity, with an explosion of local data centers and an increasing diversity of landing points.

The future is bright for these growing economies to grasp the opportunity to recover in the post-Covid world.